The Medicare Advantage (MA) program relies on honest and reliable risk adjustment to appropriately reimburse payers. What happens when MA companies use methods to make beneficiaries appear sicker?

A recently released report from the Office of Inspector General (OIG) indicates that there is growing concern about organizations leveraging chart reviews and health risk assessments (HRAs) under the MA program for their own financial incentives. The report documents several MA programs that sought to maximize risk scores by utilizing automated retrospective chart reviews and/or home health risk assessments to document diagnoses.

Findings from the Report

The report noted that in 2020 both CMS and the OIG concurred on the need for oversight of MA organizations conducting automated chart reviews or HRAs. Through a multi-year review, focusing on results from 2017 and 2018, the OIG examined 162 companies that generated diagnoses through either an automated chart review or an HRA. The analysis detected extreme asymmetry between the attributed membership and risk adjustment payments:

“We found that 20 of the 162 MA companies drove a disproportionate share of the $9.2 billion in payments from diagnoses that were reported only on chart reviews and HRAs, and on no other service records.”

The report pointed to these two methods as potentially vulnerable to inappropriate documentation of the diagnoses. The 20 organizations mentioned represented only 12% of the companies, yet were paid 54% of the risk adjustment dollars generated. One company was particularly imbalanced, generating 40% of the risk adjustment payments alone. Because of their actions, those MA companies are now subject to ongoing scrutiny and oversight by CMS.

Risk Assessment Performed Properly

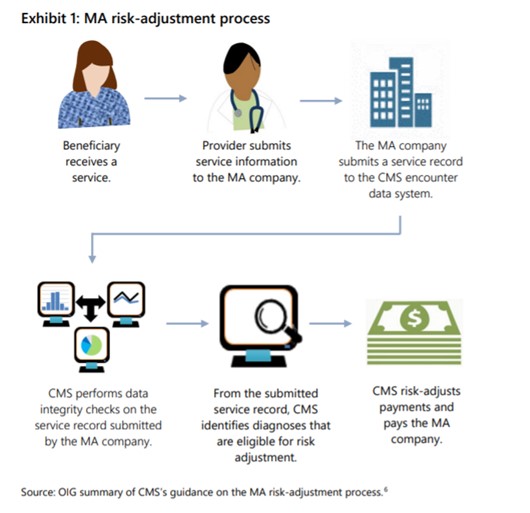

The challenge for CMS and the rest of the industry is that risk adjustment remains a critical component to a functional reimbursement model. When performed properly the process accounts for the variability of patient profiles among different markets, locales, and populations. Theoretically, the process should be straightforward, as quoted from the report:

“The risk-adjustment process generally begins when the beneficiary receives a service or medical item from a provider. The provider submits claims information, including diagnoses, to the MA company on the basis of the service or medical item provided to the beneficiary. The MA company submits a record of the service (hereafter referred to as a service record) to CMS’s MA encounter data system. This service record contains claims information or administrative data, including the diagnoses.” (see exhibit 1 below)

The Challenges of Documentation

The vast majority of providers and health systems aim to appropriately diagnose patients and provide the highest possible quality of care. The question is how to do so effectively in a financially sustainable way. There are common documentation methods that rely on technical resources, team process work-flow steps, or yet more work from our providers. Often providers are requested to receive, organize, and review diagnoses that come from other providers in the healthcare system, not only what is in the electronic medical record. These approaches can achieve good levels of success, but may not be sufficient to completely capture the various diagnoses for the entire population. The ability to capture all marginal diagnoses is crucial to a profitable and sustainable physician enterprise. A key challenge across the industry is the relentless nature of the annual diagnosis process, which is why some have resorted to the automated or HRA methods now under scrutiny. Further, clinical teams are also asked to capture other population health or HEDIS metrics in addition to diagnoses. These measures represent similar documentation and resource challenges.

Engaging the Entire Care Team Leads to… Better Care

What does this mean for health plans and health systems? We can be certain that this is not the only forensic audit being conducted; authorities are on the lookout for bad actors across all of the government programs, so proceed with caution if you are considering using solely technology-based tools to perform risk assessment.

For most organizations with limited resources, identifying an efficient method of data and diagnosis capture that withstands regulatory scrutiny can unlock the promise of the value-based model. Emerging models that utilize activity-specific bonuses are leveraging existing care team resources to optimize this capture, elevating the providers to function at the top of their license all while delivering high quality care and ensuring financial sustainability. Stellar Health believes that engaging the full care team through a platform that delivers micro-incentives for tactical actions can achieve those goals. Overall, an engaged clinical team can improve overall performance and the patient experience.

How can we help you?

- View a product demo

- Schedule a meeting

- Partner with us